- Cost planning

- Cost Analysis

- Cost management Techniques

- Externally oriented Cost Management Techniques

- Relevant costs

- Short term decisions

- Risk and Uncertainty

- Linear programming – graphical method

- Linear programming the simplex method

- Multi Product CVP Analysis

- Pricing decisions and Pricing strategies

- Budgetary Control

- Performance Evaluation

- Measuring performance in divisionalised businesses

- Transfer pricing

Responsibility centres

The area of operations for which a manager is responsible might be called a responsibility centre. Within an organisation, there could be a hierarchy of responsibility centres.

A large organisation can be structured in one of two ways: functionally (all activities of a similar type within a company, such as production, sales, research, are under the control of the appropriate departmental head) or divisionally (split into divisions in accordance with the products or services made or provided).

A divisional structure will lead to decentralisation of the decision-making process and divisional managers may have the freedom to set selling prices, choose suppliers, make product mix and output decisions and so on.

Decentralisation or divisionaliation

Decentralisation seeks to overcome the problem of managing a large organisation by creating a structure based on several autonomous decision-making units.

Objectives

- Ensure goal congruence

- Increase motivation of management

- Reduce head office bureaucracy

- Provide better training for junior and middle management

Advantages of divisionalisation

- Divisionalisation can improve the quality of decisions made and decisions should be taken more quickly.

- The authority to act to improve performance should motivate divisional managers.

- Divisional organisation frees top management from detailed involvement in day-to-day operations and allows them to devote more time to strategic planning.

The major disadvantage of decentralisation is the potential for dysfunctional decision making, i.e. where divisions make decisions in their own best interests, but which are not good from the company point of view.

The problem is overcome by introducing a suitable system of performance evaluation.

Performance evaluation

Objectives

- Promote goal congruence

- Encourage initiative and motivation

- Provide feedback to management

- Encourage long-term rather than short term views

These objectives can only be achieved with the introduction of responsibility centres.

Responsibility accounting

Responsibility accounting is a system of accounting that segregates revenue and costs into areas of personal responsibility in order to monitor and assess the performance of each part of an organisation.

Dividing an organization into different areas or segments based on areas of responsibility is known as responsibility accounting.

It is usual in budgeting to apply the principles of responsibility accounting. In responsibility accounting, a specific manager is given the responsibility for a particular aspect of the budget, and within the budgetary control system, he or she is then made accountable for actual performance.

There are a number of types of responsibility accounting unit or responsibility centre that can be used within a system of responsibility accounting.

In the weakest form of decentralisation a system of cost centres might be used. As decentralisation becomes stronger, the responsibility accounting framework will be based around profit centres. In its strongest form investment centres are used.

Each cost centre, profit centre and investment centre should have its own budget, and its manager should receive regular budgetary control information relating to the centre, for control and performance measurement purposes.

Attributable costs and controllable costs

If the principle of controllability is applied, a manager should be made responsible and accountable only for the costs (and revenues) that the manager is in a position to control. In responsibility accounting, an attributable cost is a cost that can be specifically identified with a particular responsibility centre. No arbitrary apportionment is necessary to share the cost over a number of different responsibility centres. Most attributable costs will be controllable costs.

Controllable costs are generally assumed to be variable costs, and directly attributable fixed costs.

An item that is uncontrollable for one manager could be controllable by another. In responsibility accounting, it is important to identify areas of responsibility. Within a system of responsibility accounting, there should be cost centre managers accountable for these costs.

Cost centres

If a manager is responsible for a particular aspect of operating costs, the responsibility centre is a cost centre. The manager has no responsibility for earning revenues or for controlling the assets and liabilities of the centre.

A cost centre could be large or small, such as an entire department or the activities associated with a single item of equipment.

Functional departments such as production, personnel and marketing might be treated as cost centres and made responsible for their costs.

A performance report for a cost centre might look like this:

Two important points to note about this report are as follows:

- The report should include only controllable costs and, there should be a clear distinction in the report between controllable costs and uncontrollable costs.

- The actual costs are compared with a budget that has been flexed to the actual activity level achieved.

Revenue centres

The manager of a revenue centre is responsible only for raising revenue but has no responsibility for forecasting or controlling costs. Such responsibility would pass to a more senior manager to whom the revenue centre manager reports.

Revenue centres are often used for control purposes in not-for-profit organisations such as charities.

Profit centres

A profit centre is a part of a business accountable for both costs and revenues. If a manager is responsible for revenue as well as costs, the responsibility centre is a profit centre.

A profit centre’s performance report, in the same way as that for a cost centre, would identify separately the controllable and non-controllable costs. A profit centre performance report might look like this:

The budget for the sales revenue and variable cost of sales will be flexed according to the activity level achieved and the variances could be analysed in further detail for the profit centre manager.

Notice that three different ‘profit levels’ are highlighted in the report.

- Contribution, which is within the control of the profit centre manager.

- Directly attributable gross profit, which is also within the manager’s control

- Net profit, which is after charging certain uncontrollable costs and which is therefore not controllable by the profit centre manager.

*There could be several cost centres within a profit centre, with the cost centre managers responsible for the costs of their particular area of operations, and the profit centre manager responsible for the profitability of the entire operation.

Investment centres

An Investment Centre is a ‘Profit centre with additional responsibilities for capital investment and possibly for financing, and whose performance is measured by its return on investment’. If a manager is responsible for investment decisions as well as for revenues and costs, the responsibility centre is an investment centre.

*There could be several profit centres within an investment centre.

Return on investment (ROI)

Return on investment (ROI) is usually used to monitor the performance of an investment centre.

Return on investment (ROI) is generally regarded as the key performance measure. The main reason for its widespread use is that it ties in directly with the accounting process, and is identifiable from the statement of profit or loss and statement of financial position.

Return On Investment (ROI) or Return On Capital Employed (ROCE) shows how much profit has been made in relation to the amount of capital invested and is calculated as:

PBIT x 100

Capital employed

- Profit is usually taken after depreciation but before interest and tax.

- Capital employed is total assets less current liabilities or total equity plus long term debt. Use net assets if capital employed is not given.

There is no generally agreed method of calculating ROI and it can have behavioural implications and lead to dysfunctional decision making when used as a guide to investment decisions. It focuses attention on short-run performance, whereas investment decisions should be evaluated over their full life.

Advantages

- Widely used and accepted.

- As a relative measure it enables comparisons to be made with divisions or companies of different sizes.

- It can be broken down into secondary ratios for more detailed analysis.

Disadvantages

- May lead to dysfunctional decision making.

- Different accounting policies can confuse comparisons.

- ROCE increases with age of asset if NBVs are used, thus giving managers an incentive to hang on to possibly inefficient, obsolescent.

ROI and decision-making

If investment centre performance is judged by ROI, managers of investment centres will probably decide to undertake new capital investments only if these new investments are likely to increase the ROI of their centre.

ROI should not be used to guide investment decisions, but there is a difficult motivational problem. If management performance is measured in terms of ROI, any decisions which benefit the company in the long term but which reduce the ROI in the immediate short term would reflect badly on the manager’s reported performance. In other words, good investment decisions would make a manager’s performance seem worse than if the wrong investment decision were taken instead.

Residual income (RI)

Residual Income (RI) is ‘Profit minus a charge for capital employed in the period’

Residual income (RI) can also be used to measure the performance of investment centres. However, it has a number of weaknesses that make it less preferable than ROI as a performance measure.

RI can sometimes give results that avoid the behavioural problem of dysfunctionality. Its weakness is that it does not facilitate comparisons between investment centres, nor does it relate the size of a centre’s income to the size of the investment.

Calculating RI

An alternative way of measuring the performance of an investment centre, instead of using ROI, is residual income (RI). Residual income is a measure of the centre’s profits after deducting a notional or imputed interest cost.

- The centre’s profit is after deducting depreciation on capital equipment.

- Notional interest on capital = the capital employed in the division multiplied by a notional cost of capital or interest rate.

Advantages

- It reduces ROCE’s problem of rejecting projects with a ROCE in excess of the company’s target, but lower than the division’s current ROCE.

- The cost of financing a division is brought home to divisional managers.

Disadvantages

- Does not facilitate comparisons between divisions.

- Does not relate the size of a division’s profit to the assets employed in order to obtain that profit.

RI versus ROI: marginally profitable investments

Residual income will increase if a new investment is undertaken which earns a profit in excess of the imputed interest charge on the value of the asset acquired. Residual income will go up even if the investment only just exceeds the imputed interest charge, and this means that ‘marginally profitable’ investments are likely to be undertaken by the investment centre manager.

In contrast, when a manager is judged by ROI, a marginally profitable investment would be less likely to be undertaken because it would reduce the average ROI earned by the centre as a whole.

Economic value added (EVA)

Economic value added (EVA) is a measure of performance similar to residual income, except the profit figure used is the ECONOMIC profit and the capital employed figure used is the ECONOMIC capital employed.

The basic concept of EVA is that the performance of a company as a whole, or of investment centres within a company, should be measured in terms of the value that has been added to the business during the period. It is a measure of performance that is directly linked to the creation of shareholder wealth.

In order to add to its economic value, a business must make an economic profit in excess of the cost of the capital that has been invested to earn that profit.

Calculating EVA

EVA Summary:

PAT is adjusted to give the Net Operating Profit after tax (NOPAT) XX

Less: The economic value of the capital employed x cost of capital (XX)

Measuring EVA

The difficulties in applying EVA in practice arise from the problem of establishing the economic profit in a period, and the economic value of capital employed. These values are estimated by making adjustments to accounting profits and accounting capital employed.

- Accounting profits are based on the accruals concept of accounting, whereas NOPAT for EVA is based on cash flow profits. Adjustments have to be made to convert from an accruals basis to a cash flow basis.

- Depreciation of non-current assets is a charge in calculating EVA as well as accounting profit. Economic depreciation is the fall in the economic value of an asset during the period.

- It might be assumed that the accounting charge for depreciation is a good approximation of the economic cost of depreciation, in which case no adjustment to accounting profit is necessary.

- Alternatively, it might be assumed that the economic value of the assets are their net replacement cost, in which case economic depreciation will be based on replacement cost. An adjustment to accounting profit should then be made for the amount by which economic depreciation exceeds the accounting charge for depreciation.

- Similarly, an adjustment might be necessary for intangible non-current assets such as goodwill.

- Where a company had made a provision for doubtful debts, this should be reversed. Any adjustment in the income for an increase or decrease in the provision for doubtful debts should be reversed, and NOPAT increased or reduced accordingly.

- Spending by the company on development costs should not be charged in full against profit in the year the expenditure occurs. Instead, it should be capitalised because it has added to the economic value of capital employed, and it should then be amortised over an appropriate number of years. In practice, the adjustment can be made by:

- increasing NOPAT by the net increase in capitalised development costs, and

- increasing the economic value of capital employed by the same amount.

- All leases should be capitalised. Finance leases will have been capitalised already, but operating leases should be capitalised too, and the economic value of capital employed increased to include the current value of operating leases.

Using EVA

Economic value added can be used to:

- set targets for performance for investment centres (divisions) and the company as a whole.

- measure actual performance.

- plan and make decisions on the basis of how the decision will affect EVA.

Advantages of EVA

The advantages of EVA are as follows:

- It is a performance measure that attempts to put a figure to the increase (or decrease) that should have arisen during a period from the operations of a company or individual divisions within a company.

- Like accounting return and residual income, it can be measured for each financial reporting period.

- It is easily understood by non-accountants.

- It is based on economic profit and economic values of assets, not accounting profits and asset values.

EVA versus RI

EVA and RI are similar because both result in an absolute figure which is calculated by subtracting an imputed interest charge from the profit earned by the investment centre. However, there are differences as follows:

- The profit figures are calculated differently. EVA is based on an ‘economic profit’ which is derived by making a series of adjustments to the accounting profit.

- The notional capital charges use different bases for net assets. The replacement cost of net assets is usually used in the calculation of EVA.

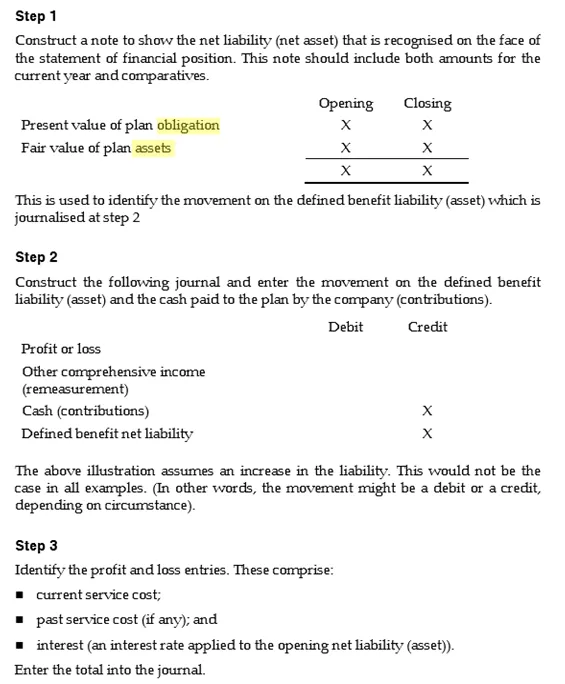

Step 4

Step 4