Overview

Statements of cash flows, as their name indicates, report cash flows that have occurred during the period. The only non-cash items included in a statement of cash flows are adjustments to the profit before tax, when the indirect method is used to present cash flows from operating activities. These IAS 7 notes are prepared by mindmaplab team and covering IAS 7 full standard, IAS 7 statement of cash flows with illustrative examples, the definition of cash and cash equivalents, disclosure requirements, IAS 7 format both indirect method and direct method. This summary of IFRS 7 cash flow statement is a full text summary of IAS 07. We have also prepared the IAS 7 pdf version download.

IAS Standards

IAS 2 Inventories

IAS 7 Statements of cash flows

IAS 7 Statement of cash flows – Revisited

IAS 8 Accounting policies, changes in accounting estimates, and errors

IAS 10 Events after the reporting period

IAS 16 Property, plant and equipment

IAS 20 Accounting for government grants and disclosure of government assistance

IAS 21 The effects of changes in foreign exchange rates

IAS 24 Related party disclosures

IAS 27 Consolidated and separate financial statements

IAS 28 Investments in associates and joint ventures

IAS 32 Financial instruments: presentation

IAS 33 Earnings per share – Revisited

IAS 37 Provisions, contingent liabilities and contingent assets

IFRS Standards

IFRS 5 Non-current assets held for sale and discontinued operations

IFRS 7 Financial instruments: disclosures

IFRS 10 Consolidated financial statements

IFRS 12 Disclosure of interests in other entities

IFRS 13 Fair value measurement

IFRS 15 Revenues from contracts with customers

IAS 17 VS IFRS 16 Lease – Differences

The purpose of IAS 7 statements of cash flows

IAS 7 Statements of cash flows requires an entity to prepare a statement of cash flows and to present it as a key financial statement.

The statement of cash flows provides information on:

- Liquidity – Generation of cash and use of cash (and cash equivalents)

- Viability – Ability to survive

- Adaptability – Ability to respond to change

Statements of cash flows, as their name indicates, report cash flows that have occurred during the period. The only non-cash items included in a statement of cash flows are adjustments to the profit before tax, when the indirect method is used to present cash flows from operating activities.

IAS 7 Consolidated statements of cash flows

The special features of a consolidated statement of cash flows

The rules for preparing a group statement of cash flows are similar to the rules for a statement of cash flows for an individual entity.

However, there are additional items in a consolidated statement of cash flows that are not found in the statement of cash flows of an individual company. The most significant of these are cash flows (or adjustments to profit before tax) relating to:

- Non-controlling interests (e.g. Dividends paid).

- Associates (or JVs) (e.g. Share of profit, Dividends received).

- Acquiring or disposing of subsidiaries during the year.

- Foreign exchange loss.

Cash flows from operating activities

The following additional items adjustments should be made such as:

- Subtract share of profit of associates and joint ventures

- Add share of loss of associates and joint ventures

- Exchange rate differences

- A loss arising from exchange rate differences must be added

- A gain arising from exchange rate differences must be subtracted.

Cash flows from investing activities

Cash flows in this section of the consolidated statement of cash flows include the following additional items:

- Subtract Acquisition of subsidiary, net of cash acquired

- Add Proceeds from disposing of subsidiaries during the year (disposal proceeds minus any cash in the subsidiary at the disposal date)

- Subtract cash paid to acquire shares in an associate (or JV) during the year

- Add cash received from the disposal of shares in an associate (or JV) during the year

- Add Dividends received from associates

*Note that when a subsidiary has been acquired, the working capital brought into the group (receivables plus inventory minus trade payables of the acquired subsidiary) is paid for in the purchase price to acquire the subsidiary. This is treated as a separate item in the investing activities section of the statement of cash flows.

Cash flows from financing activities

The additional items these cash flows include:

- Subtract Dividends paid to non-controlling interests (NCI)

- Subtract cash paid as a new loan to or from an associate (or JV) during the year

- Add cash received as a repayment of a loan to or from an associate (or JV) during the year.

* Note that dividends received from an associate (or JV) are shown as cash flows from investing activities; whereas dividends paid to non-controlling interests in subsidiaries are (usually) shown as cash flows from financing activities.

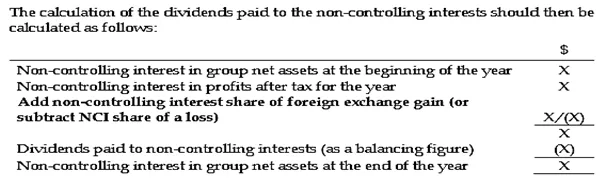

Non-controlling interests and the group statement of cash flows

*Unless there is an acquisition or a disposal of a subsidiary during the year, the only cash flow relating to non-controlling interests is the amount of dividends paid to the non-controlling interests by subsidiaries.

If there is a gain or loss on translation of a foreign subsidiary, the non-controlling interest has a share of this exchange gain or loss.

To calculate dividend payments to non-controlling interests, we must therefore remove the effect of exchange rate differences during the year.