Overview

IAS 19 Employee benefits are all forms of consideration given by an entity in exchange for service rendered by employees or for the termination of employment. IAS 19 revised provides guidance on accounting for all forms of employee benefits, except for share-based payments. Share-based payments are dealt with by IFRS 2. These IAS 19 notes are prepared by mindmaplab team and covering IAS 19 employee benefits calculation with example, employee benefits IFRS, retirement and pension accounting, projected unit credit method under IAS 19, the termination benefits, IAS 19 defined benefit plan, actuarial gains and losses, IAS 19 short term employee benefits and with all the disclosure requirements with examples and a summary of everything. We have also prepared the IAS 19 pdf version download.

IAS Standards

IAS 2 Inventories

IAS 7 Statements of cash flows

IAS 7 Statement of cash flows – Revisited

IAS 8 Accounting policies, changes in accounting estimates, and errors

IAS 10 Events after the reporting period

IAS 16 Property, plant and equipment

IAS 20 Accounting for government grants and disclosure of government assistance

IAS 21 The effects of changes in foreign exchange rates

IAS 24 Related party disclosures

IAS 27 Consolidated and separate financial statements

IAS 28 Investments in associates and joint ventures

IAS 32 Financial instruments: presentation

IAS 33 Earnings per share – Revisited

IAS 37 Provisions, contingent liabilities and contingent assets

IFRS Standards

IFRS 5 Non-current assets held for sale and discontinued operations

IFRS 7 Financial instruments: disclosures

IFRS 10 Consolidated financial statements

IFRS 12 Disclosure of interests in other entities

IFRS 13 Fair value measurement

IFRS 15 Revenues from contracts with customers

IAS 17 VS IFRS 16 Lease – Differences

The scope and basic principles of IAS 19

Employee benefits are all forms of consideration given by an entity in exchange for service rendered by employees or for the termination of employment. IAS 19 provides guidance on accounting for all forms of employee benefits, except for share-based payments. Share-based payments are dealt with by IFRS 2.

IAS 19 sets out rules of accounting and disclosure for:

- Short term employee benefits;

- salaries, wages

- paid annual leave and paid sick leave

- profit-sharing and bonuses

- non-monetary benefits (such as medical care, housing, cars and free or subsidised goods or services) for current employees.

- Post-employment benefits;

- retirement benefits

- post-employment life insurance and post-employment medical care

- Other long-term employee benefits;

- long-service leave pays

- long-term disability benefits

- Termination benefits

Accounting principle

IAS 19 requires an entity:

- to recognise a liability when an employee has provided a service in exchange for a benefit that will be paid in the future, and

- to recognise an expense when the entity makes use of the service provided by the employee.

The basic double entry may therefore be:

Debit: Employment cost (charged as an expense in the statement of profit or loss)

Credit: Liability for employee benefits

Short-term employee benefits

Short-term employee benefits are employee benefits that are expected to be settled wholly within twelve months. Discounting the liability to a present value is not required, because it is payable within 12 months.

Short-term paid absences

Entitlement to paid absences falls into two categories:

- Accumulating

- Are carried forward for use in future periods if the current period’s entitlement is not used in full

- expense and liability is recognised when employees render service that increases their entitlement to future paid absences

- measured at the additional amount expected to be paid as a result of the unused entitlement that has accumulated at the end of the reporting period.

- Non-accumulating:

- unused amounts cannot be carried forward

- expense and liability is recognised when the absences occur

Profit-sharing and bonus plans

The expected cost of profit-sharing and bonus payments must be recognised when, and only when:

- the entity has a present legal or constructive obligation to make such payments as a result of past events; and

- a reliable estimate of the obligation can be made.

A present obligation exists when, and only when, the entity has no realistic alternative but to make the payments.

Termination benefits

An entity must recognise a liability and expense for termination benefits at the earlier of the following dates:

- when the entity can no longer withdraw the offer of those benefits; and

- when the entity recognises costs for a restructuring within the scope of IAS 37 that involves the payment of termination benefits.

Termination benefits are measured in accordance with the nature of the employee benefit, that is to say short term benefits, other long- term benefits or postemployment benefits.

Other long-term benefits

- Other long-term employee benefits are all employee benefits other than short-term employee benefits, post-employment benefits and termination benefits.

- An entity must recognise a net liability (asset) for any other long-term benefit. This is measured as:

- the present value of the obligation for the benefit; less

- the fair value of assets set aside to meet the obligation (if any).

- Movements in the amount from one year to the next are recognised in P&L.

Post-employment benefits

Post-employment benefits are employee benefits that are payable after the completion of employment. The most significant post-employment benefit is a retirement pension.

Post-employment benefit plans – are formal or informal arrangements under which an entity provides post-employment benefits for one or more employees. There are two types:

Defined contribution plans

- In a defined contribution pension plan, the employer pays an agreed amount of money (‘defined contributions’) at regular intervals into a pension fund for the employee. The amount of money that the employer contributes is usually a fixed percentage of the employee’s wages or salary (e.g. 5% of the employee’s basic salary).

- The contributions to the fund are invested to earn a return and increase the value of the fund.

- The amount of pension received by the employee is not pre-determined, but depends on the size of the employee’s share of the fund at retirement. The entity will have no legal or constructive obligation to pay further contributions if the fund does not hold sufficient assets to pay all employee benefits relating to employee service in the current and prior periods.

Accounting treatment: contributions to defined contribution schemes

- the contributions payable for the reporting period are charged to profit or loss as an expense (an employee cost) in the statement of profit or loss.

- any unpaid contributions at the end of the year will be shown in the statement of financial position as an accrual/liability and any prepaid contributions will be shown as an asset (a prepayment).

Defined benefit plans (final salary schemes)

Under a defined benefit plan, the employer guarantees the amount of pension that its employees will receive after they retire. A company might save cash into a separate fund (just as for defined contribution plans) in order to build up an asset that can be used to pay the pensions of employees when they retire. This would be known as a funded plan. If an employer does not save up in this way the plan is described as being unfunded.

The amount that an employee will receive is usually linked to the number of years that he or she has worked for the company, and the size of his/her annual salary at retirement date (or on leaving the company).

If there are insufficient funds in the plan to provide employees with the guaranteed pensions then the employer must make up the shortfall.

Role of an actuary

An actuary will advise the company how much to pay in contributions into the pension plan each year, in order to ensure there are sufficient funds to cover the company’s obligation to make the pension payments.

It is very unlikely that the actuary’s estimates will be 100% accurate so whenever the value of the pension fund assets and the employer’s pension obligations are measured, the company may find that there is a deficit or a surplus.

- When the amount of the employer’s future pension obligations is more than the value of the investments in the pension fund, the fund is in deficit.

- When the value of the investments in the pension fund is higher than the value of the employer’s obligations to make future pension payments, the fund is in surplus.

When a surplus or deficit occurs, an employer might take no action. Alternatively, the company might decide to eliminate a deficit (not necessarily immediately) by making additional contributions into the fund.

When the fund is in surplus, the employer might stop making contributions into the fund for a period of time (and ‘take a pension holiday’). Alternatively the company may withdraw the surplus from the fund, for its own benefit.

Accounting for defined benefit plans

Statement of financial position

IAS 19 requires that an entity must recognise a defined benefit item (net liability due to a deficit or net asset due to a surplus) in the statement of financial position.

The net defined benefit liability (asset) is the deficit or surplus and is measured as:

- the present value of the defined benefit obligation; less

- the fair value of plan assets (if any).

A surplus in a defined benefit plan is measured at the lower of:

- the surplus in the defined benefit plan; and

- the asset ceiling (which is the present value of any economic benefits available in the form of refunds from the plan or reductions in future contributions to the plan).

The present value of a defined benefit obligation is the present value, without deducting any plan assets, of expected future payments required to settle the obligation resulting from employee service in the current and prior periods.

Movement for the period

The movements on the defined benefit item are due to:

- cash contributions to the plan

- current service cost (to P&L);

- past service cost (to P&L);

- gains or loss on settlement (to P&L);

- net interest (expense or income) (to P&L); and

- remeasurement (to OCI);

The benefit paid has no effect as it reduces the plan assets and plan obligations by the same amount.

Movements recognised through OCI:

Remeasurements of the net defined benefit liability (asset) comprise:

- actuarial gains and losses (are changes in the present value of the defined benefit obligation);

- any change in the effect of the asset ceiling, excluding amounts included in net interest on the net defined benefit liability (asset).

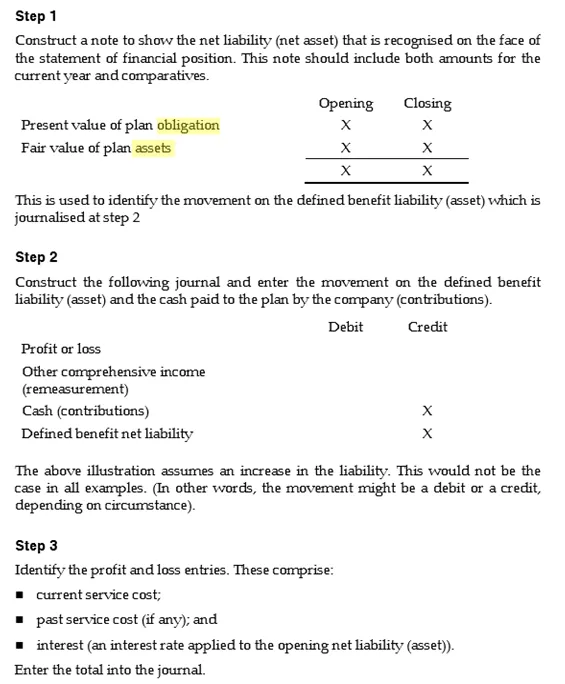

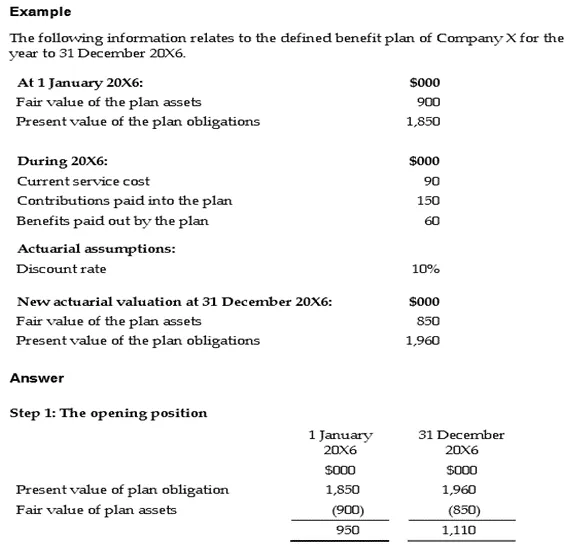

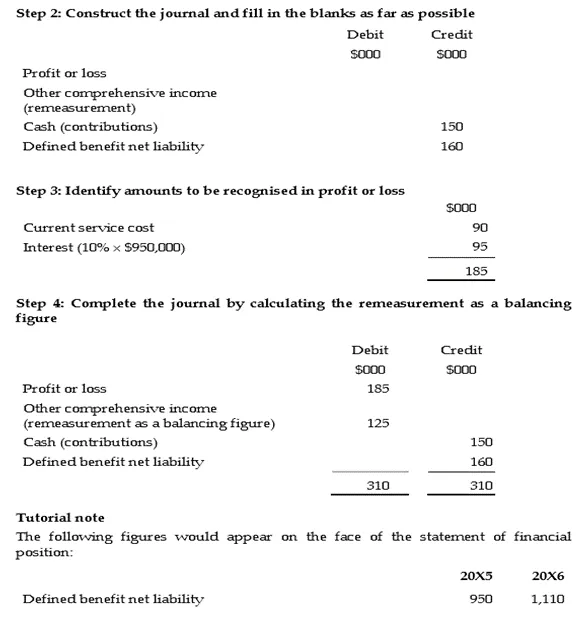

Accounting for defined benefit pension plans

Step 4

Step 4

Calculate the remeasurement as a balancing figure.

IAS 19 requires disclosure of reconciliations of the present value of the defined benefit obligation and the fair value of the defined benefit assets.

Past service cost

Past service cost is the change in the present value of the defined benefit obligation resulting from a plan amendment or curtailment.

Past service cost may be either positive (when benefits are introduced or changed so that the present value of the defined benefit obligation increases) or negative (when benefits are withdrawn or changed so that the present value of the defined benefit obligation decreases).

Recognition

Past service cost must be recognised as an expense at the earlier of:

- when the plan amendment or curtailment occurs

- when related restructuring costs are recognized

Asset ceiling test

IAS 19 requires that an entity must recognise a defined benefit item (net liability due to a deficit or net asset due to a surplus) in the statement of financial position.

However, if the net item is a surplus it is subject to a test which puts a ceiling on the amount that can be recognised. This is known as the “asset ceiling” test.