- Cost planning

- Cost Analysis

- Cost management Techniques

- Externally oriented Cost Management Techniques

- Relevant costs

- Short term decisions

- Risk and Uncertainty

- Linear programming – graphical method

- Linear programming the simplex method

- Multi Product CVP Analysis

- Pricing decisions and Pricing strategies

- Budgetary Control

- Performance Evaluation

- Measuring performance in divisionalised businesses

- Transfer pricing

Learning curve

The learning curve is ‘The mathematical expression of the commonly observed effect that, as complex and labour-intensive procedures are repeated, unit labour times tend to decrease. These learning curve notes are prepared by mindmaplab team and covering the learning curve meaning, factors affecting learning curve, learning rate curve with examples. These learning curve in management accounting notes also covers skill curve and learning curve questions with answers and solutions. These summary notes also covers the life cycle costing process, calculating life cycle cost, life cycle costing questions and answers pdf. We have also prepared the learning curve pdf version download.

The learning curve

The learning curve theory

The learning curve is ‘The mathematical expression of the commonly observed effect that, as complex and labour-intensive procedures are repeated, unit labour times tend to decrease. The learning curve models mathematically this reduction in unit production time.’

The learning curve theory states that the cumulative average time per unit produced is assumed to decrease by a constant (fixed) percentage every time total output of the product doubles.

The doubling of output is an important feature of the learning curve measurement.

The learning curve improves performance, which in turn reduces the time taken per unit and increases the productivity.

The effect that learning casts on employees, can be represented by a line called a learning curve. It displays the relationship between the production time per unit and the cumulative number of units produced. Learning curve has a direct impact on direct labor wages.

Eventually when the worker has had enough experience and nothing more is left for him to learn, then the learning process stops i.e. the learning would stop after a certain time limit and beyond specific number of units produced.

Improvements in the learning effect will not continue indefinitely. There will come a time when no further improvements can be made (known as a steady state).

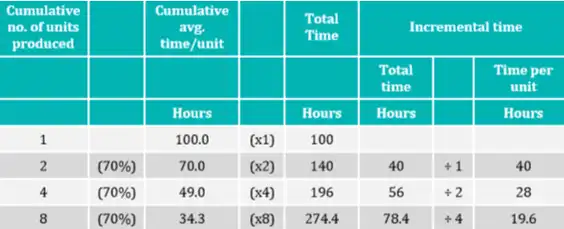

For Example:

If the first unit of output requires 100 hours and a 70% learning effect occurs, then determine the production times for:

- Total production

- Incremental total hours

- Incremental hours per unit

Formula for the learning curve

The formula for the learning curve is

Yx = aXb

Where

Y = cumulative average time per unit to produce X units

a = the time required to produce the first unit of output

X = the cumulative number of units

b = the learning coefficient or the index of learning/learning index

By calculating the value of b, using logarithms or a calculator, expected labour times can be calculated for certain work.

Example:

Find the value of b when a 90% learning curve effect takes place.

b = log 0.9/log 2

= -0.0458/0.3010

= -0.152

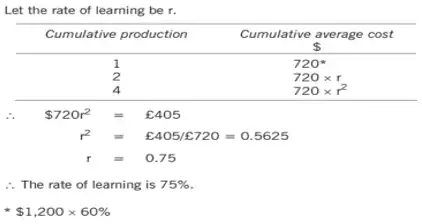

Derivation of the learning rate

The approach to derive the learning rate very much depends on the information given in the question. If you are provided with details about cumulative production levels of 1, 2, 4, 8 or 16 (etc) units, the following approach should be used:

Example:

BL is planning to produce product A. Development tests suggest that 60% of the variable manufacturing cost of product A will be affected by a learning and experience curve. This learning effect will apply to each unit produced and continue at a constant rate of learning until cumulative production reaches 4,000 units, when learning will stop. The unit variable manufacturing cost of the first unit is estimated to be $1,200 (of which 60% will be subject to the effect of learning), while the average unit variable manufacturing cost of four units will be $405.

Calculation of the percentage learning effect

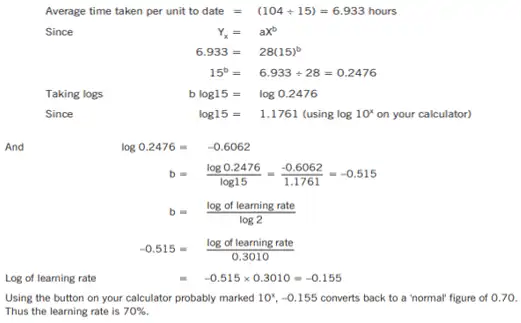

If other than details about cumulative production levels of 1, 2, 4, 8 or 16 (etc.) units given, use the following approach, which involves the use of logarithms.

Example:

XX is aware that there is a learning effect for the production of one of its new products, but is unsure about the degree of learning. The following data relate to this product.

Time taken to produce the first unit 28 direct labour hours

Production to date 15 units

Cumulative time taken to date 104 direct labour hours

Calculation of percentage learning effect using logs

What costs are affected by the learning curve?

- Direct labour time and costs

- Variable overhead costs, if they vary with direct labour hours worked

- Materials costs are usually unaffected by learning among the workforce, although it is conceivable that materials handling might improve, and so wastage costs be reduced.

- Fixed overhead expenditure should be unaffected by the learning curve (although in an organisation that uses absorption costing, if fewer hours are worked in producing a unit of output, and the factory operates at full capacity, the fixed overheads recovered or absorbed per unit in the cost of the output will decline as more and more units are made).

Experience curves

The learning curve effect can be applied more broadly than just to labour. There are also efficiency gains in other areas;

- As methods are standardised material wastage and spoilage will decrease

- Machine costs may decrease as better use is made of the equipment

- Process redesign may take place. As understanding of the process increases, improvements and short-cuts may be developed.

- Learning curve labour efficiency will have a knock-on effect on the fixed cost per unit.

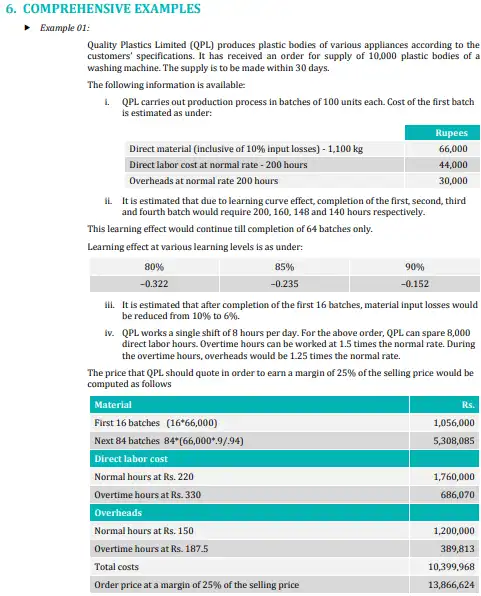

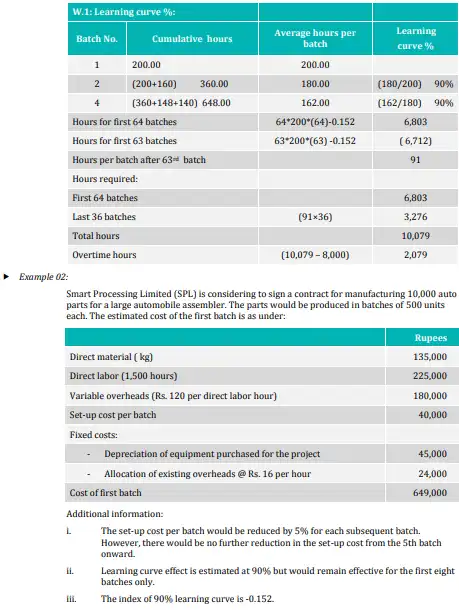

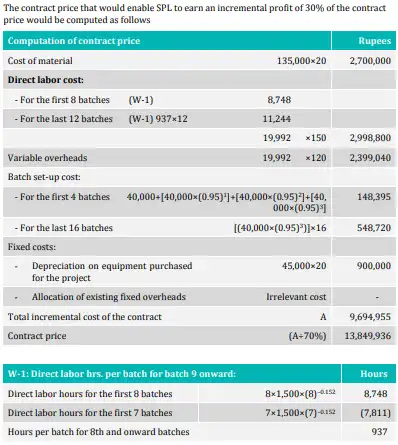

Comprehensive Examples

Life cycle costing

Life cycle costing is another technique used in cost planning.

Product life cycle costs are incurred from the design stage through development to market launch, production and sales, and their eventual withdrawal from the market.

Component elements of a product’s cost over its life cycle:

- Research & development (R&D) costs – design, testing, production process and equipment

- Technical data cost – cost of purchasing any technical data required

- Training costs – including initial operator training and skills updating

- Production costs

- Distribution costs – transportation and handling costs

- Marketing costs – customer service, field maintenance, brand promotion

- Inventory costs – holding spare parts, warehousing and so on

- Retirement and disposal costs – costs occurring at the end of the product’s life

Life cycle costs can apply to:

- Services;

- physical products

- customers

- projects

Life cycle costing, on the other hand, tracks and accumulates actual costs and revenues attributable to each product over the entire product life cycle.

Life cycle cost of Product A = Total costs of Product A over its entire lifecycle

Total number of units of A

Then, the total profitability of any given product can be determined.

The application of life cycle costing requires the establishment of a life cycle cost budget for a given product which in turn necessitates identification of costs with particular products. Actual costs incurred in respect of the product are then monitored against life cycle budget costs.

The product life cycle

It is important to know where a product is in its life cycle as this will affect expectations regarding sales volume and types of costs incurred. The stages include:

- Development

- Introduction

- Growth

- Maturity

- Decline

Where the product is in its life cycle will also affect the returns that are expected.

If a product is in the introductory or growth stages, it cannot be expected to be a net generator of cash, as all the cash it generates will be used in expansion through increased sales and so on. As the product moves from maturity towards decline, it is of prime importance that the product still generates a profit and cash and that its return on capital is acceptable.

Maximising the return over the product life cycle

There are a number of factors that need to be managed in order to maximise a product’s return over its lifecycle:

- Careful design of the product and manufacturing and other processes will keep cost to a minimum over the life cycle.

- If an organisation is launching a new product, it is vital to get it to the market place as soon as possible. This will give the product as long a period as possible without a rival in the market place and should mean increased market share in the long run.

- A short breakeven time (BET) is very important in keeping an organisation liquid. The sooner the product is launched, the quicker the R&D costs will be repaid.

- Product life cycles are not predetermined; they are set by the actions of management and competitors. Generally, the longer the life cycle, the greater the profit that will be generated, assuming that production ceases once the product goes into decline and becomes unprofitable. One way to maximise the life cycle is to get the product to market as quickly as possible because this should maximise the time in which the product generates a profit. Only on knowing the lifecycle costs of a product can a business decide appropriately on its price.

Service and project life cycles

A service organisation will have services that have life cycles. For example, a company leasing heavy machinery to clients could use LCC to predict the total costs, resources, utilisation and productivity for an asset over its entire life cycle: thus, LCC is an excellent tool for assessing alternatives, which has made it very common in the procurement of large assets.

Products that take years to produce or come to fruition are usually called projects, and discounted cash flow calculations are invariably used to cost them over their life cycle in advance. The projects need to be monitored very carefully over their life to make sure that they remain on schedule and that cost overruns are not being incurred.

Customer life cycles

Not all investment decisions involve large initial capital outflows or the purchase of physical assets. The decision to serve and retain customers can also be a capital budgeting decision even though the initial outlay may be small. Customers also have life cycles, and an organisation will wish to maximise the return from a customer over their life cycle. The aim is to extend the life cycle of a particular customer.

Target costing

Definition: Target costing is an activity which is aimed at reducing the life-cycle costs of new products, while ensuring quality, reliability, and other consumer requirements, by examining all possible ideas for cost reduction at the product planning, research and development, and the prototyping phases of production.

Target costing works in the opposite way to normal methods of pricing, by setting a selling price and then working backwards to find the target cost.

The planning, design and development stages of a product’s cycle are therefore critical to an organisation’s cost management process.

*The traditional approach is to develop a product, determine the expected standard production cost of that product and then set a selling price.

* The target costing approach is to develop a product concept and the primary specifications for performance and design and then to determine the price customers would be willing to pay for that concept. The desired profit margin is deducted from the price, leaving a figure that represents total cost. This is the target cost and the product must be capable of being produced for this amount, otherwise the product will not be manufactured.

Target Cost

Target Cost is a pro-active cost control system. The target cost is calculated by deducting the target profit from a predetermined selling price based on customers’ views. (Target cost = Selling price – Target profit margin)

Cost Gap

A cost gap is to be calculated by comparing current cost (estimated cost) and the target cost. This cost gap is to be close/reduced over time by applying effective cost reduction techniques, improving technologies and processes such as value engineering, Functional analysis, value analysis, which looks at every aspect of the value chain business function.

Target cost gap = Estimated product cost – Target cost

Questions that a manufacturer may ask in order to close the gap include:

- Can any materials be eliminated, e.g. cut down on packing materials?

- Can a cheaper material be substituted without affecting quality?

- Can labour savings be made without compromising quality, for example, by using lower skilled workers?

- Can productivity be improved, for example, by improving motivation?

- Can production volume be increased to achieve economies of scale?

- Could cost savings be made by reviewing the supply chain?

- Can part-assembled components be bought in to save on assembly time?

- Can the incidence of the cost drivers be reduced?

- Is there some degree of overlap between the product-related fixed costs that could be eliminated by combining service departments or resources?

A key aspect of this is to understand which features of the product are essential to customer perceived quality and which are not. This process is known as ‘value analysis’. Attention should be focused more on reducing the costs of features perceived by the customer not to add value.

*Closing the cost gap by increasing the selling price is not a viable option as the price is determined by market forces rather than the company.

Target costing in service organisations

Target costing is as relevant to the service sector as the manufacturing sector. Key issues are similar in both: the needs of the market need to be identified and understood as well as its customers and users; and financial performance at a given cost or price (which does not exceed the target cost when resources are limited) needs to be ensured.

Problems with target costing in service industries

Unlike manufacturing, service industries have the following characteristics which could make target costing more difficult:

- The intangibility of what is provided means that it is difficult to define the ‘service’ and attribute costs.

- Heterogeneity – The quality and consistency varies, because of an absence of standards or benchmarks to assess services against.

- Perishability – the unused service capacity from one time period cannot be stored for future use. Service providers and marketers cannot handle supply-demand problems through production scheduling and inventory techniques.

- No transfer of ownership – Services do not result in the transfer of property. The purchase of a service only confers on the customer access to or a right to use a facility.

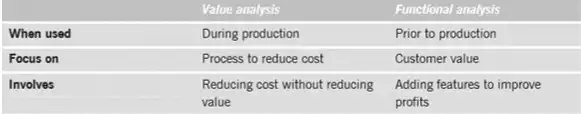

Value analysis

Value analysis is ‘A systematic inter-disciplinary examination of factors affecting the cost of a product or service, in order to devise means of achieving the specified purpose most economically at the required standard of quality and reliability’.

It looks at trying to reduce costs without reducing the value to the customer. The value of the product must therefore be kept the same or else improved, at a reduced cost.

Value Engineering – is ‘Redesign of an activity, product or service so that value to the customer is enhanced while costs are reduced (or at least increase by less than the resulting price increase)’.

*Value engineering is cost avoidance or cost prevention before production, whereas value analysis is cost reduction during production.

There are two features of value analysis that distinguish it from other approaches to cost reduction.

- It encourages innovation and a more radical outlook for ways of reducing costs because ideas for cost reduction are not constrained by the existing product design.

- It recognises the various types of value which a product or service provides, analyses this value, and then seeks ways of improving or maintaining aspects of this value, but at a lower cost.

Any commercial organisation should be continually seeking lower costs, better products and higher profits. These can be achieved in any of the following ways:

- Cost elimination or cost prevention

- Cost reduction

- Improving product quality and so selling greater quantities at the same price as before

- Improving product quality and so being able to increase the sales price Value analysis can achieve all four of these objectives.

Four aspects of value should be considered in value analysis are:

- cost value

- exchange value

- use value

- esteem value

Functional analysis

Functional analysis is ‘An analysis of the relationships between product functions, their perceived value to the customer and their cost of provision’.

Functional analysis is a cost management technique which has similarities with value analysis.

Advantages

- Competitive advantage resulting from improved, cost-effective design or redesign of products.

- Information about product functions and about the views of customers is integrated into the formal reporting system.

- Probably of most benefit during the planning and design stages of new products.

Comparison of value and functional analysis

Value analysis focuses on cost reduction through a review of the processes required to produce a product or service. Functional analysis focuses on the value to the customer of each function of the product or service and then makes a decision as to whether cost reduction is necessary.