Overview

IFRS 10 Consolidated Financial Statements – Guidance on the process of consolidation is set out in two standards, IFRS 3 Business Combinations and IFRS 10 Consolidated Financial Statements. IFRS 10 explains that a business under the control of another is a subsidiary and the controlling entity is the parent. These IFRS 10 summary notes are prepared by mindmaplab team and covering, IFRS 10 revised amendment, the key definitions, full standard with illustrative examples, IFRS 10 investment entity, IFRS 10 control, IFRS 10 exemption from consolidation, objective of IFRS 10, IFRS 10 special purpose entities, with IFRS 10 disclosure requirements. This IFRS 10 is a guide for dummies as well as for professionals. This is the IFRS 10 full text guide; we have also prepared IFRS 10 pdf version download.

IAS Standards

IAS 2 Inventories

IAS 7 Statements of cash flows

IAS 7 Statement of cash flows – Revisited

IAS 8 Accounting policies, changes in accounting estimates, and errors

IAS 10 Events after the reporting period

IAS 16 Property, plant and equipment

IAS 20 Accounting for government grants and disclosure of government assistance

IAS 21 The effects of changes in foreign exchange rates

IAS 24 Related party disclosures

IAS 27 Consolidated and separate financial statements

IAS 28 Investments in associates and joint ventures

IAS 32 Financial instruments: presentation

IAS 33 Earnings per share – Revisited

IAS 37 Provisions, contingent liabilities and contingent assets

IFRS Standards

IFRS 5 Non-current assets held for sale and discontinued operations

IFRS 7 Financial instruments: disclosures

IFRS 10 Consolidated financial statements

IFRS 12 Disclosure of interests in other entities

IFRS 13 Fair value measurement

IFRS 15 Revenues from contracts with customers

IAS 17 VS IFRS 16 Lease – Differences

International accounting standards and group accounts

The following standards relate to accounting for investments:

- IFRS 3 Business combinations

- IFRS 10 Consolidated financial statements

- IFRS 11 Joint Arrangements

- IAS 27 Separate financial statements

- IAS 28 Investments in associates and joint ventures

Guidance on the process of consolidation is set out in two standards, IFRS 3 Business Combinations and IFRS 10 Consolidated Financial Statements.

Introduction to IFRS 10

IFRS 10 explains that a business under the control of another is a subsidiary and the controlling entity is the parent.

IFRS 10 covers the on-going rules related to consolidation. It is IFRS 10 that requires:

- that the financial statements of Parent and Subsidiary be prepared using uniform accounting policies;

- the consolidated assets, liabilities, income and expenses are those of the parent and its subsidiaries added on a line by line basis;

- the elimination of unrealised profit on intra group transactions; and

- the cancellation of intra group balances.

- IFRS 10 explains how to account for disposals.

IFRS 10 Definitions

Control – An investor controls an investee when:

- it is exposed, or has rights, to variable returns from its involvement with the investee; and

- it has the ability to affect those returns through its power over the investee.

Non-controlling interest (NCI) – the equity in a subsidiary not attributable to a parent.

The non-controlling interest may be stated as either:

- a proportionate share of the identifiable assets acquired and liabilities assumed; or

- at fair value as at the date of acquisition

Consolidated financial statements – The financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and its subsidiaries are presented as those of a single economic entity.

The requirement to prepare consolidated accounts

An entity that is a parent must present consolidated financial statements. There is an exception to this rule.

A parent need not present consolidated financial statements if (and only if) it meets all of the following conditions:

- The parent itself (X) is a wholly-owned subsidiary, with its own parent (Y).

- Alternatively, the parent (X) is a partially-owned subsidiary, with its own parent (Y), and the other owners of X are prepared to allow it to avoid preparing consolidated financial statements.

- The parent’s debt or equity instruments are not traded in a public market.

- The parent does not file its financial statements with a securities commission for the purpose of issuing financial instruments in a public market.

- The parent’s own parent, or the ultimate parent company (for example, the parent of the parent’s parent), does produce consolidated financial statements for public use that comply with International Financial Reporting Standards.

The following might be given as spurious justification for failing to consolidate a particular subsidiary:

- The subsidiary’s activities are dissimilar from those of the parent, so that the consolidated financial statements might not present the group’s financial performance and position fairly.

- Obtaining the information needed would be expensive and time-consuming and might delay the preparation of the consolidated financial statements.

- The subsidiary operates under severe long-term restrictions, so that the parent is unable to manage it properly.

Investment entities exemption

An investment entity might take shares in another entity in order to make gains through dividends or capital appreciation, not to become involved in business of that entity.

An investment entity must not consolidate the entities that it controls but it must measure them at fair value through profit or loss in accordance with IFRS 9 Financial Instruments.

An entity is an investment entity only if it meets all of the following criteria:

- Its only substantive activities are investing in multiple investments for capital appreciation, investment income (dividends or interest), or both.

- It has made an explicit commitment to its investors that its purpose of investment is to earn capital appreciation, investment income (dividends or interest), or both.

- Ownership in the entity is represented by units of investments, such as shares or partnership interests, to which proportionate shares of net assets are attributed.

- The funds of its investors are pooled so that they can benefit from professional investment management.

- It has investors that are unrelated to the parent (if any), and in aggregate hold a significant ownership interest in the entity.

- Substantially all of the investments of the entity are managed, and their performance is evaluated, on a fair value basis.

- It provides financial information about its investment activities to its investors.

Group financial statements – Disposals

IFRS 10 Consolidated Financial Statements contains rules on accounting for disposals of a subsidiary.

Accounting for a disposal is an issue that impacts the statement of profit or loss.

There are two major tasks in constructing a statement of profit or loss for a period during which there has been a disposal of a subsidiary:

- The statement of profit or loss must reflect the pattern of ownership of subsidiaries in the period.

- When control is lost, the statement of profit or loss must show the profit or loss on disposal of the subsidiary.

The rules in IFRS 10 cover full disposals and part disposals.

Full disposals

Profit or loss on disposal

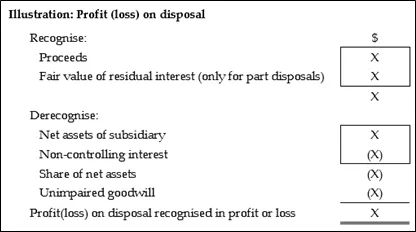

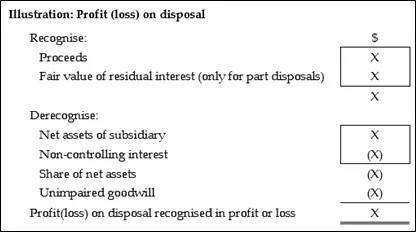

IFRS 10 specifies an approach to calculating the profit or loss on disposal.

This approach involves comparing the asset that is recognised as a result of the disposal (i.e. the proceeds of the sale) to the amounts that are derecognised as a result of the disposal.

The calculation of profit or loss on disposal must be supported by several other calculations. These are:

- the goodwill arising on acquisition, which in turn needs the net assets of the subsidiary at the date of acquisition; and

- the net assets of the subsidiary at the date of disposal, which in turn needs a calculation of the equity reserves at the date of disposal.

Part disposals

When a parent makes a part disposal of an interest in a subsidiary it will be left with a residual investment. The accounting treatment for a part disposal depends on the nature of the residual investment. Whether part disposal:

- results in loss of control

- does not results in loss

Part disposal with loss of control

If a part disposal results in loss of control the parent must recognise a profit or loss on disposal in the consolidated statement of profit or loss.

Part disposal with no loss of control

A part disposal which does not result in loss of control is a transaction between the owners of the subsidiary. In this case the parent does not recognise a profit or loss on disposal in the consolidated statement of profit or loss. Instead the parent recognises an equity adjustment.

The double entry to record the equity adjustment is:

Cash Dr.

Non-controlling interest (new) Cr.

Retained earnings Cr.