Read more

- Introduction to Cost and Management Accounting

- High/Low and Linear Regression Analysis

- Inventory Management

- Accounting for Inventory

- Accounting for overheads

- Absorption Costing

- Marginal Costing

- Job Batch and Service costing

- Process Costing

- Target Costing

- Variances

- Standard Costing

- Cost Volume Profit analysis

- Relevant costing and Decision-Making Techniques

- Time Value of Money (TVM)

Variances analysis Overview

- Difference between expected results and actual results are known as variances. Variances can be either Favorable (F) or Adverse (A).

- Variances are calculated by comparing actual results with flexed budget.

- Variances are reported in a statement for the accounting period that reconciles the budgeted profit with the actual profit for the period. The statement is known as an Operating statement.

-

- Large adverse variances indicate poor performance

- Large favorable variance indicate unexpected good performance.

Variances: A summary

- Sales variances are not recorded in a standard costing system of cost accounts/cost ledger.

- Included in variance report (operating statement) to management.

- They help to reconcile the actual profit with budgeted profit.

Types

- Sales Price Variance

- Sales Volume Variance

- The method of calculating cost variances is similar for all variable production cost items (Direct material, Direct labour, Production overheads). A different method of calculating fixed production overhead.

- The total cost variance is the difference between actual and standard variable cost of production. However, total cost variance is not usually calculated. Instead it is calculated in TWO parts.

- Cost variances are adjustments to the profit in an accounting period:

-

- Favorable variances INCREASE profit.

- Adverse variances REDUCES profit.

Types

Direct cost Variance

- Direct material Variance

- Direct labour Variance

Indirect cost/overhead Variance

- Variable Production overhead Variance

- Fixed Production overhead Variance

Cost Variances

Direct material Variance

Total cost variance

The total direct material cost variance is the difference between actual material cost of actual units and the standard material cost of actual costs.

Standard material cost of actual production:

- Actual units produced x standard kg/units x standard price per kg/unit XX

Actual material cost of actual production:

- Actual units produced x Actual kg/units x Actual price per kg/unit XX

A price variance measures the difference between the actual paid for material and the price that should have been paid.

Standard material cost of actual production:

- Actual Kgs purchased x standard price per kg/unit XX

Actual material cost of actual production:

- Actual Kgs purchased x Actual price per kg/unit XX

- A usage variance measures the difference between material that were used in production and materials that should have been used.

- The difference is measured as a quantity of materials. This is converted into a money value at the standard price for material.

= Standard Price (standard quantity – Actual quantity)

Usage variance is further analysed into:

1. Material Mix Variance

= Standard Price (Total actual quantity x standard mix) – (Total actual quantity at actual mix)

2. Yield Variance

= Standard cost (standard output at actual mix) – (Actual output of actual mix)

Direct labour Variance

Direct labour Variance

Total cost variance

The total direct labour cost variance is the difference between actual labour cost in producing units and the standard labour cost of producing those actual costs.

Standard actual cost of actual production:

- Actual units produced x standard hrs/units x standard rate per hour XX

Actual labour cost of actual production:

- Actual units produced x Actual hours per unit x Actual rate per hour (XX)

A rate variance measures the difference between the actual wage rate paid to per labour hour and the rate that should have been paid.

It looks at the hours paid.

Calculated as:

= Actual hrs (standard rate – actual rate)

An efficiency variance or productivity variance measures the difference between the time taken to make the production output and the time that should have been taken.

The difference is measured in hours and converted into a money value at the standard direct labour rate per hour.

It looks at the hours worked.

Calculated as:

= Standard rate per unit (standard hrs – actual hrs)

- Idle time variance is a part of Efficiency variance.

- Sometimes idle time might be a feature of a production process, in that case the expected idle time might be built into the standard cost. If idle time is not built into the standard cost, the idle time variance is always adverse.

- Calculating the idle time variance will affect the calculation of the direct labour efficiency variance, if idle time occurs but is not recorded.

Idle time not part of standard cost

If idle time is not included in standard cost any idle time is unexpected and leads to an adverse variance.

Idle time included in standard cost

Include idle time as a separate element of standard cost so that standard cost of idle time is a part of total standard cost per unit ; or

Allow for a standard amount of idle time in standard hours per unit for each product. The standard hours per unit therefore include an allowance for expected idle time.

Variable Production Overhead variance

Variable Production Overhead variance

Total cost variance

Standard Cost

- Actual units x standard hours per unit x standard rate per hour X

Actual Cost

- Actual variable production overheads (X)

It is the difference between actual variable overhead spending in hours worked and what the spending should have been (standard rate)

Similar to a material price variance or a labour rate variance.

= Actual hours (standard rate – actual rate)

The variable overhead efficiency variance in hours is same as the labour efficiency variance in hours (excluding any idle time variance) and is calculated in a very similar way.

= Standard Rate (standard hour – actual hours)

Fixed Production Overhead variance

Fixed Production Overhead variance

- The amount of fixed production overheads represents production overheads absorbed into production cost at a standard cost per unit produced.

- The amount of fixed production overhead absorption rate is a function of the budgeted fixed production overhead expenditure and volume.

- The total fixed overhead variance is the total amount of under-absorbed or over-absorbed overheads.

Budgeted Cost

- Actual units produced x F.OH rate X

Actual Cost

- Actual overheads incurred (X)

= Budgeted F.OH – Actual F.OH

Can be measured in either units of output or standard hours.

= Standard cost (Budgeted Production – Actual Production)

Volume variance is further analyzed into:

Efficiency variance

Same as labour and variable production overhead variance in hours (worked/allowed).

= Standard Rate (standard hours – actual hours)

Capacity variance

= Standard Rate (budgeted hour – actual hour)

Excluding idle time.

Sales Variance

Sales variance

Total sales variance

= Budgeted contribution – Actual Contribution

= Actual units sold (budgeted contribution – actual contribution)

Volume variance/ Volume profit variance

= Standard contribution or profit per unit (budgeted volume – Actual volume)

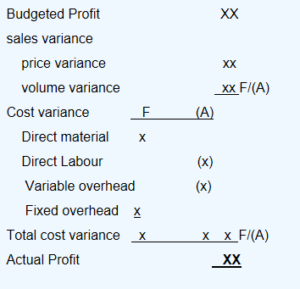

Reconciliation of Budgeted and Actual Profit (OPERATING STATEMENT)

- Operating statement reconciles profit between Budgeted and Actual by reporting all the variances to management , showing the difference between Budgeted and actual profit. Arises because of sales variance and cost variance.

- Absorption costing operating statement begins with Budgeted Profit.

- The sales variance are Next.

- The cost variance are listed next sales variance.

- Separate columns for the favorable and adverse variance.

-

- Adverse — Reduces profit

- Favorable — Add to profit.

- Actual profit is shown as final figure.

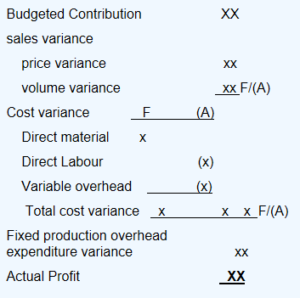

- Marginal costing operating statement – All the formatting is same as absorption costing format expect there is no fixed production overhead volume variance.

- Where as fixed cost expenditure variance are presented in a separate part of the statement.

- In marginal costing ‘Budgeted contribution’ is used instead of ‘Budgeted profit’.

Leave a Reply

You must be logged in to post a comment.